…as external, domestic debts rise

…owes largest percentage to IDB

By Jarryl Bryan

Guyana’s public debt is on the rise, with the Finance Ministry’s recent Public Debt Annual Report highlighting that since 2015, there has been a 4.1 per cent rise in Guyana’s indebtedness to creditors.

The report details that Guyana’s total debt, inclusive of external and domestic, increased to $330 billion as of December 2016. The Ministry attributed this to disbursements from the Export Import Bank of China towards the Cheddi Jagan International Airport (CJIA) expansion project, as well as monies from multilateral creditors.

A breakdown of the figures shows that total external debt amounted to $240 billion, a 72.6 per cent bite out of the total public debt. On the other hand, domestic debt stood at $90.6 billion, or 27.4 per cent of the total.

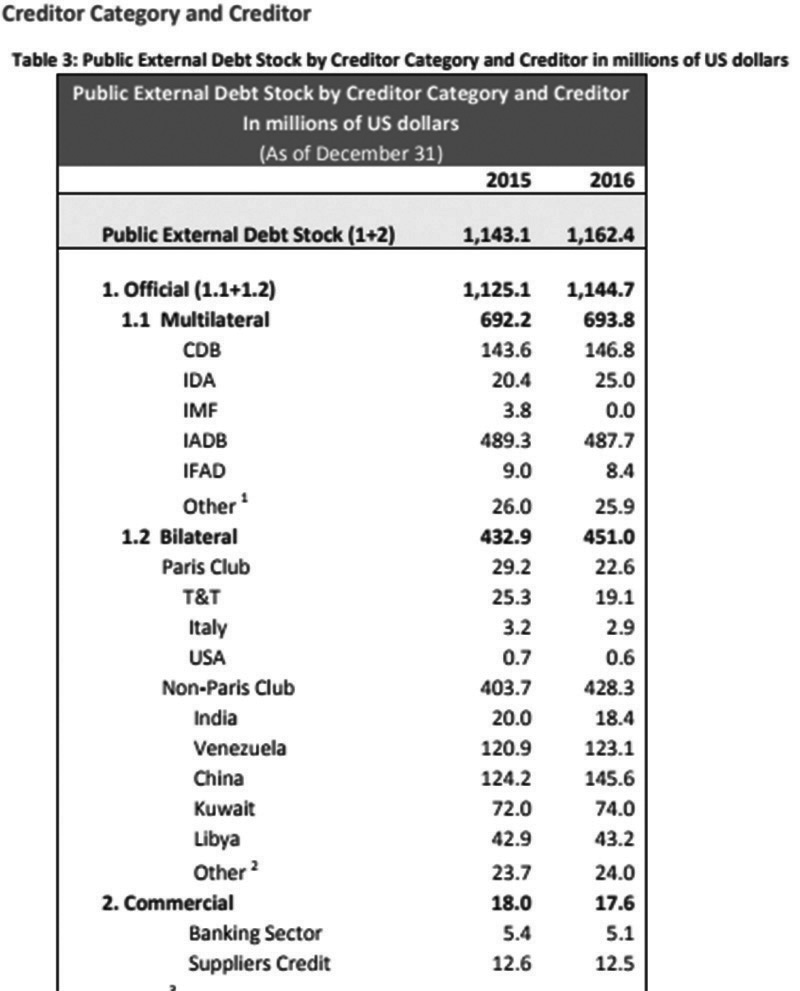

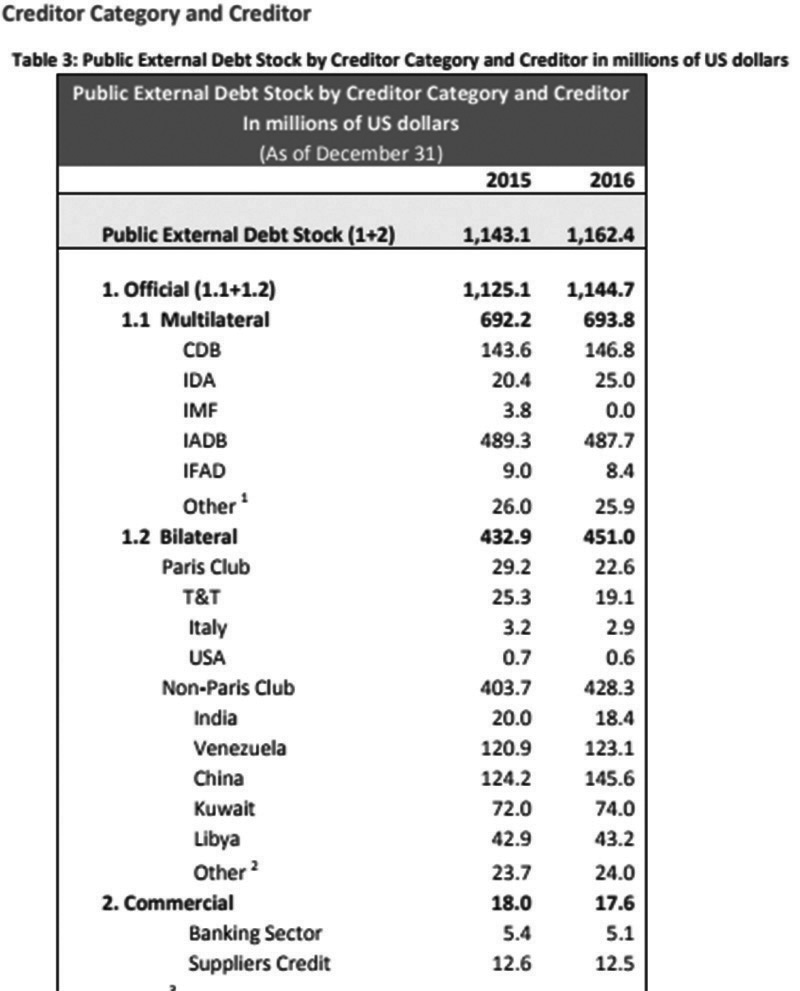

“At the end of December 2016, multilateral creditors continued to be the predominant creditor category, accounting for 59.7 per cent of the external debt portfolio, a slight decrease from the 2015 position of 60.6 per cent. Bilateral lenders and commercial lenders represented 38.8 per cent and 1.5 per cent of the public external debt portfolio, respectively,” the Ministry explained.

“Although the nominal public debt increased, the total external public debt to GDP ratio declined from 36.1 per cent as at end-December 2015 to 33.7 per cent as at end-December 2016 as a result of GDP growth outstripping the rate of growth of public external debt stock,” the Ministry said, in justifying the increase.

In 2012, the public external debt was $277.8 billion but by early 2015, that had been reduced to $236 billion. In similar manner, the domestic debt had been reduced from $93.4 billion in 2012 to $81.6 billion in 2015 before a sudden flare up in the figures after the A Partnership for National Unity/Alliance For Change took office.

According to the report, “The share of external debt to total public debt decreased marginally from 74.3 per cent at end-December 2015 to 72.6 per cent at end-December 2016, while the share of domestic debt to total debt increased from 25.7 per cent to 27.4 per cent of total debt over the same period. The increasing share of the domestic debt in Guyana’s total debt portfolio reflects Guyana’s strides to have a diversified portfolio and debt instruments.”

“The total public external debt stock continues to increase and reflects Guyana’s preferences for obtaining concessional loans whilst domestic debt stock increased as a result of an increase in the issuances of domestic securities (Treasury Bills and Debentures) in 2016,” the Finance Ministry also detailed.

Who do we owe?

But who does Guyana owe all this money to? The report notes that Guyana’s four main external creditors are the Inter-American Development Bank (IDB), the Caribbean Development Bank (CDB), the State-owned Export-Import Bank of China (China EXIM Bank) and Venezuela State-owned oil company (PDVSA).

Together, they constitute some 77.7 per cent of Guyana’s public external debt stock, as at end-December 2016, with the IDB the most dominant creditor. According to the report, the IDB has an average share of 42.0 per cent of the debt portfolio.

The CDB is Guyana’s second largest creditor, accounting for 12.6 per cent of total public external debt. The Export-Import Bank of China follows closely behind the CDB with a 12.5 per cent share of external debt, while Venezuela’s PDVSA accounted for 10.6 per cent. Important to note is PDVSA has recently been declared to be in default of its debts by a Trade group in the US.

“Kuwait and Libya, debts to (whom) are in arrears, remained Guyana’s largest non-Paris Club bilateral creditors. (They) accounted for 10.1 per cent of Guyana’s public external debt stock as at the end of December 2016. The public external debt stock by borrower category remained unchanged, in 2016.”

“The Central Government was the main beneficiary of external financing, accounting for 99.0 per cent of the debt portfolio in 2016. This represents a 1.0 per cent increase over the end-December 2015 position. On the other hand, the share of public external debt held by the Bank of Guyana decreased by 1.0 per cent due to the IMF debt being fully repaid,” the report details.

There is some amount of consolation, however, with the report noting that Guyana’s total debt to Gross Domestic Product (GDP) ratio declined by approximately two per cent – from 48.4 per cent to 46.6 per cent. This is an indicator of how well a country, in this case Guyana, can repay its debts through its GDP without incurring more.