(This is the first in a six-part series of articles focusing on the oil industry. The intention is to try and explain the entire value stream, oil strategy, and recommended action for the Guyana oil sector)

I am of the belief that if the ordinary man in the street understands what is happening, then he will hold the feet of whoever wins the 2020 elections to the fire. The bottom line remains that the post-2020 Government must be held accountable by ensuring that the oil revenues are managed responsibly and with the best interests of all the people in mind.

Right now, from what I am observing under this Granger-led PNC regime, they are far from transparent and accountable in the oil related negotiations. So my plan is to bring oil related information to the man in the street to stimulate debate on the issue. Today I shall write about upstream activities in the oil and gas sector.

What are upstream activities in the oil and gas sector?

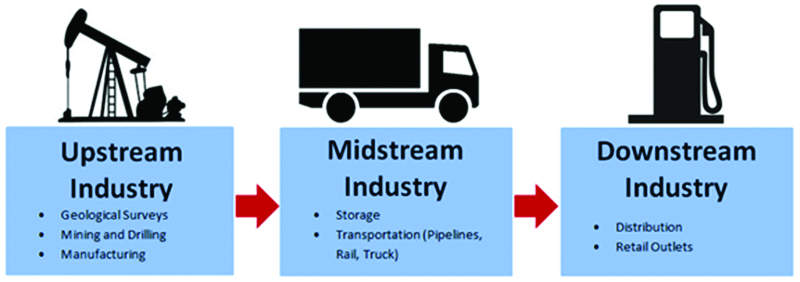

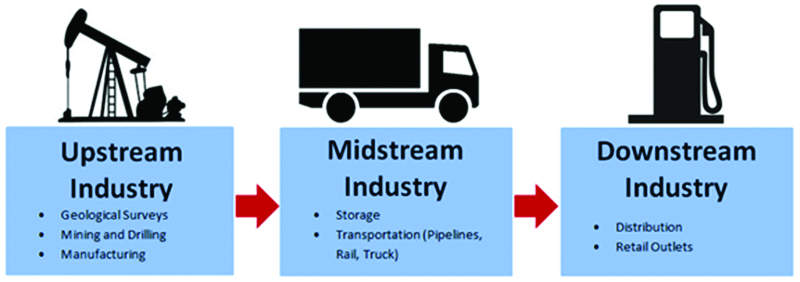

Most oil and gas companies are organised according to functionality; meaning, a range of operations suited for a specific purpose. The most upstream segment of the oil and gas functionality is known as “EXPLORATION AND PRODUCTION” (E & P). The E & P function encompasses activities related to searching for, recovering, and producing crude oil and natural gas.

In Guyana’s case, Exxon told us on May 20, 2015 (immediately after the change of Government in the May 2017 elections) that they made a significant discovery in the 26,000-sq.km prospective offshore oilfields called the “Stabroek Block”. The reliable estimate of these aggregated discoveries in that “Stabroek Block” is now reported at some 1.2 billion barrels of crude oil. It is comforting to know that within that geographic vicinity of Guyana’s discoveries is a proven oil reserve in Venezuela of some 300 billion barrels of oil. My conclusion: Exxon is on to something really big here, but they are in no haste to get to the finish line. Guyana is in Exxon’s long-term strategy as they march right back into Venezuela post-Maduro.

What is also of importance here is that the Granger-led PNC regime is not even rolling out their thought set on the production of natural gas. Is it all going to be burnt off? Is there no economic value to be secured for Guyana from the natural gas? In 2011, the AFC financier Mr. Badal had an excellent idea to run a natural gas pipeline from Trinidad to Guyana to transform GPL into a reliable and cheap supplier of energy. Why are we not considering running a pipeline from the “Stabroek Block” to GPL to realise that dream and bring an end to blackouts?

Upstreaming in the oil industry is all about the wells. What is key to this entire theme is how to design, construct, operate and manage these wells efficiently. Upstream activities are very capital intensive in nature, and require less staff and more equipment. Therefore, this functionality is a critical contributor to the “DUTCH Disease” (DD) phenomenon. If we cut off the Guyanese people from participating at the upstream level, Guyana can be a primary candidate for the DD. Thus the policy makers, especially Minister Trotman, must think out of the box on conceptualising how the nation can more actively participate in midstream and downstream oil and gas-related activities.

In the upstream functionality, the scope and opportunity for Guyana to secure the greatest possible return on its investment by way of the sovereign land is extremely low. The real money is in the midstream and downstream activities. We shall explain that midstream, downstream and DD concept in another column.

The game plan of Exxon is to pull out as much profit as it can at the upstream functional level, and take the raw product elsewhere for further processing. This strategy is Exxon’s gain and Guyana’s loss.

Exxon can only accomplish this strategy by leaving behind the smallest human and environmental footprint as they can in Guyana. Bottom line: when the time comes, they want to be able to cap and leave the area without any major “after-cost”. All they are interested in is crude oil, because they have enough active plants at the midstream and downstream levels in other parts of the world that can process the crude to create the targeted value-added revenue that are multiples of the price of raw crude oil.

I trust the readers have gotten a grasp of the extent of the looting that is about to happen if the Government does not create the investment climate for the construction of an oil refinery in Guyana.

Next week, I shall move to exploration.