Attempts to ascertain the status of the Guyana Sugar Corporation (GuySuCo) pension fund, which reports indicate is in a deficit, have hit a proverbial roadblock as the Minister responsible for the sector is unaware of its status.

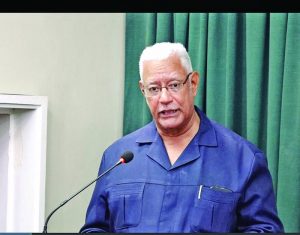

When contacted on Monday about the status of the fund, Agriculture Minister Noel Holder said he was unable to say whether the fund was in a deficit or healthy.

According to the Minister, who is overseas, he would not be able to provide information on Government’s plan to secure financial benefits for pensioners as he was not “up to date” on the situation.

He referred Guyana Times to acting GuySuCo Chief Executive Officer Paul Bhim, noting that he should provide an update on the situation before it is escalated to him. According to Holder, however, he would seek clarification from GuySuCo himself on the matter. Efforts to contact Bhim proved futile.

In the past, there has been confusion over who has responsibility for GuySuCo – Minister Holder or Finance Minister Winston Jordan. The Special Purpose Unit (SPU) is an arm of the National Industrial and Commercial Investments Limited (NICIL), itself an arm of the Finance Ministry. The SPU has been leading the divestment of GuySuCo. Jordan has since affirmed that the Finance Ministry was overseeing the “rump” GuySuCo.

Paul Bhim