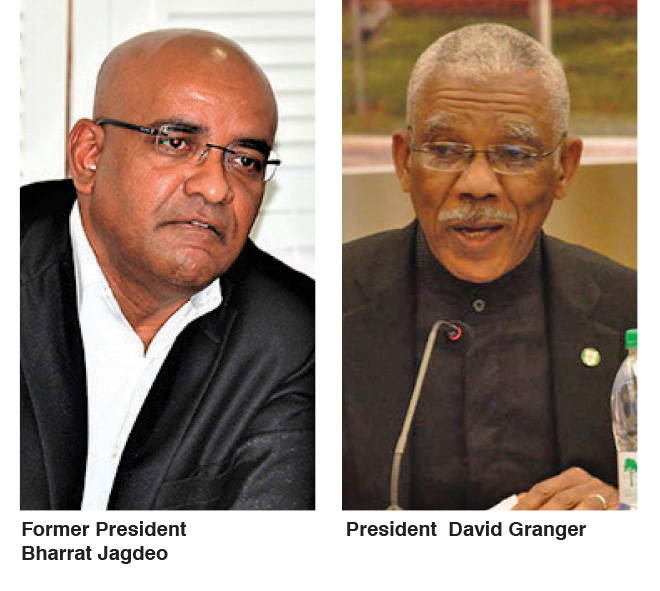

Home News Govt can advocate against remittance tax – Jagdeo

…calls for Granger to make more use of Caricom chairmanship

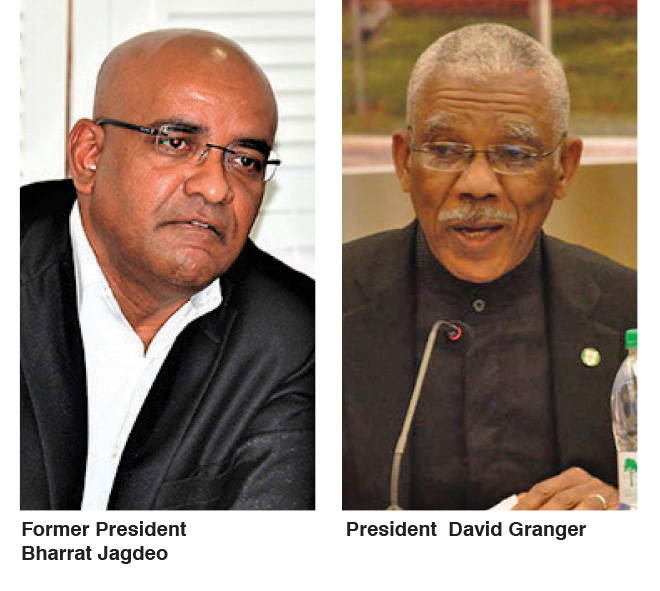

While Government has acknowledged that the United States tax on remittances to the Caribbean will have an effect on Guyanese, it has adopted a wait-and-see approach to the issue.

But the fact that Guyana’s President, David Granger, is Chair of the Caribbean Community (Caricom) puts him in a position to do more advocacy for the Region’s benefit. This is according to former President Bharrat Jagdeo.

“I’m arguing for a more proactive approach,” Jagdeo said, when asked to comment on the Government’s wait-and-see stance. “The President is now the Chairman of Caricom. He has an additional responsibility outside of the national one. He should say, here are four or five issues: the trade issues, the financial sector issues, climate issues, remittances, immigrants, that we would like to engage the US on and try to move Caricom to request such an engagement,” he posited.

According to the former President, President Granger now has an opportunity to do such advocacy. Jagdeo, a Moscow-trained economist, recalled that during the time he chaired Caricom, in 2009, regional initiatives were promoted.

He expressed fear that by the time Granger’s six months as Chairman would have elapsed, there would have been little change or advancement. Granger assumed the chairmanship of Caricom in January 2017, for a six-month term.

With the newly-proposed tax measures on remittances from the US to foreign countries, including Guyana, economists have predicted that remittances would dry up.

During a recent post-Cabinet press briefing, Minister of State, Joseph Harmon said there was little the Government could do at this time. The Minister acknowledged that the measure would, however, have an effect on the country.

“As the saying goes when certain people sneeze, everyone else catches a cold. When the Americans make their laws, we have to deal with the consequences of it. What I can say is that it means it will cost you more to send money from the United States to Guyana,” Harmon had said.

“As you know, remittances have been a major plank in the sustenance of many families in this country. And I think it is going to have an impact on them,” Harmon said. “But we will have to look and see what happens. It may be that instead of getting a hundred dollars, you get ninety.” But the Minister went on to stress that “there is nothing really we as a State can do about the way another country makes its laws. All we can say is encourage those who send money to their families here to increase the amount”.

It is expected that the US Congress may make an amendment to the US Electronic Fund Transfer Act to impose a fee for remittance transfers to certain foreign countries, including Guyana.

The Bill, which is titled Border Wall Funding Act of 2017 (HR 1813), has already been introduced in the US House of Representatives by Congressman Mike Rogers, of Alabama’s 3rd Congressional District.

In introducing the Bill on March 30, 2017, Rogers claimed that remittances were normally used by illegal immigrants to move money from the US to their home countries.

In order to put a restriction on this, Rogers said, the Bill will seek to allow for a two per cent fee charged on individuals sending money to recipients in 42 countries in Latin America and the Caribbean.

Remittances are a major part of Guyana’s Gross Domestic Product (GDP), at one point accounting for 25 per cent. In recent years, however, there has been a drop.