Dear Editor,

Citizens Bank Inc (CBI), a subsidiary of Banks DIH Ltd, has this week released its unaudited half-year 2017 performance as at the end of March 2017. That document clearly could not have been great reading for the shareholders. However, it has to be worse reading for any thinking policy maker in the Government of Guyana, because of the low tax declaration.

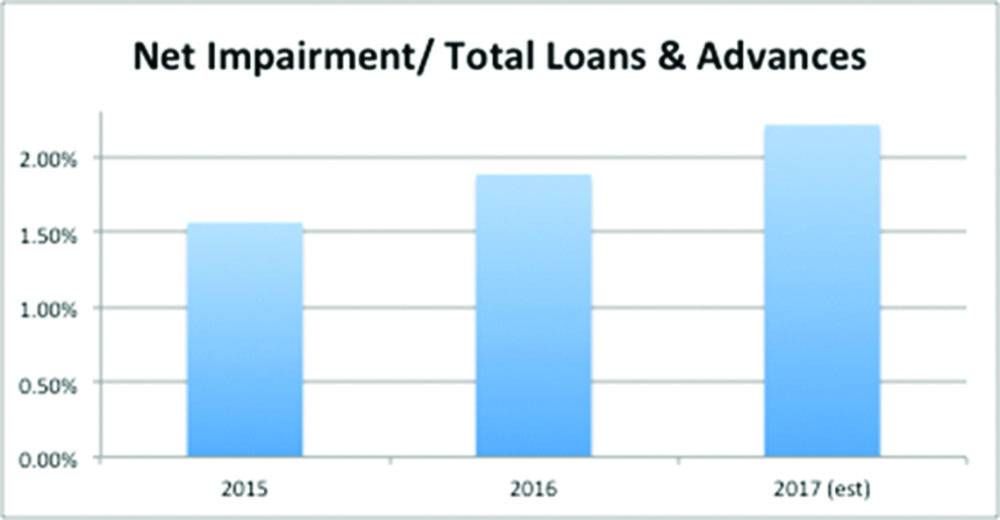

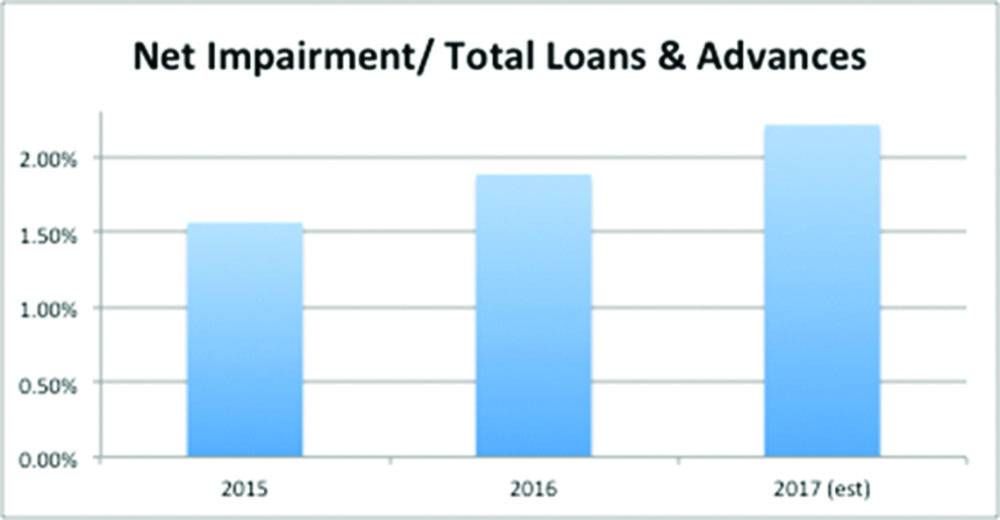

What is of concern to me as a financial analyst is the state of the net impairment of financial assets at this institution since 2015. Between 2015 and 2016, the ratio of net impairment to the total loan portfolio deteriorated by some 20%. At the end of the 2016 financial year in September, loan impairment expenses net of recoveries were G$548 million, derived from a net loan portfolio of G$29 billion. Compare this with the situation in the largest bank in Guyana (Republic) and you realise CBI is in real trouble. Republic, with double the loan portfolio, booked an annual loan impairment expense slightly more than that of CBI.

From the graph below, one can observe the rapid expansion of the pool of good cash that has to be set aside to fund the write-off of potentially bad loans in the bank’s loan portfolio. In 2017, this ratio of good cash to be set aside to fund the write-off of bad loans is expected to be slightly more than 2.1% of the total loan portfolio, compared to 1.5% in 2015 (see graph below). That is almost a 45% expansion in this ratio, and it cannot be great news for the shareholders.

I have had cause to write about the two bigger banks in the industry (GBTI and Republic) in the immediate past, between April 8, 2017 and the date of this letter; but this discovery confirms my fear that the situation in the smaller banks is even worse.

But what should be a deep concern to the Granger Administration is that the risk of the smaller banks unravelling is much higher than let us say a Republic, which has a much better-diversified income stream than baby banks like CBI.

I have been saying since February 2017 that we do have a systemic problem in the banking sector, but, to date, the public policies to strengthen the financial sector seems to be lost on Mr Winston Jordan. This is his show, but he chooses to issue empty sound-bytes that have no substance.

With the dataset at our disposal, we can confirm that, with respect to CBI, at the end of their financial year in September 2016, their non-performing loans to total loans were 15.5% compared to the industry average of 11.3%. Mind you, the industry saw the quality of its loan portfolio deteriorate by 1.9% between September 2015 and September 2016, which translated to over $2.5 billion in debts being reclassified from “Acceptable” to “Substandard”. Some G$548 million (22%) of that figure came from CBI. But what is worrying is the largest bank in Guyana (Republic), which has twice the loan portfolio of CBI, has a smaller amount of bad debts.

This information confirms my original suspicion that the smaller indigenous banks like Citizen’s Bank, which do not have an international head office to back them with capital, are definitely in a position to bring greater harm to the financial sector because of their higher risk outlook for the next 12 months.

What can be deduced from this situation? This country is burning financially under President Granger’s watch, and he has to be held accountable for leading a team that seems hell-bent on repressing the private sector in some utopian quest to destroy the current set of investors for some “new breed of phantom investors”. This strategy is clearly not working, and in the end, all inside Guyana will suffer as the investment climate implodes.

In the case of CBI, pre-tax profit declined by some 48% over their 2016 financial year to G$759 million. If one were to look at these March 2017 published data from CBI, one would recognize a trend that will sees the loan portfolio actually declining. How do banks make profits? Yes, the loan portfolio. What does that say about the profitability of this bank for 2017?

But what was most distressing news is that CBI paid Gy$58 million in taxes for the six months to March 31, 2017, as against G$125 million and G$137 million for the comparable period to March 31, 2016 and March 31, 2015.

The Guyanese man in the street must settle his mind to the fact this rut will not be fixed in six months. It will take years to turn back the clock to a bullish business environment; and therefore, the days of austerity are alive in Guyana today, and will be so possibly for the rest of the Granger term. It is time for people to cease buying this high nonsense that the first flow of oil will solve all the nation’s problems; it is a blatant misrepresentation of the facts. The years 2017/2018 will be hard guava season, oil or no oil, because of the gross mismanagement of the economy in 2016.

Even if the oil is to flow today, it will take at least 18 months to 24 months to feel the impact; but the oil is not flowing until 2022, which will compute to positive impacts by 2024. That is some 6 years away.

Regards,

Sase Singh