In previous articles, this author estimated that over the next five–ten years, the estimated total public and private investments in major infrastructure and developmental projects can amount to more than GY$7 trillion or an average of GY$720 billion annually in public and private investments. The current average total public and private investments from looking at the trend over the last ten years was approximately GY$345 billion annually. With Guyana’s development trajectory, this sum can increase annually by 52% or by GY$180 billion to over $524 billion within the next decade.

In the view of these likely developments where the country is heading and the private sector’s vigorous appetite for investment in infrastructure–the question arises: does the local financial sector have financial wherewithal to accommodate these unprecedented large-scale investment projects? In an attempt to answer this question, an examination of the financial sector’s capacity is undertaken herein.

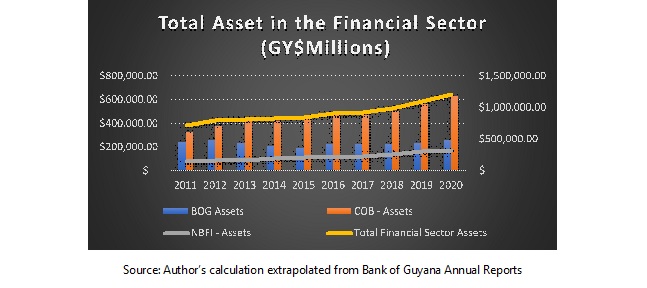

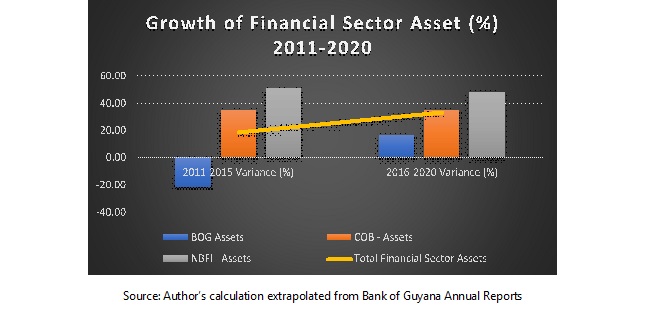

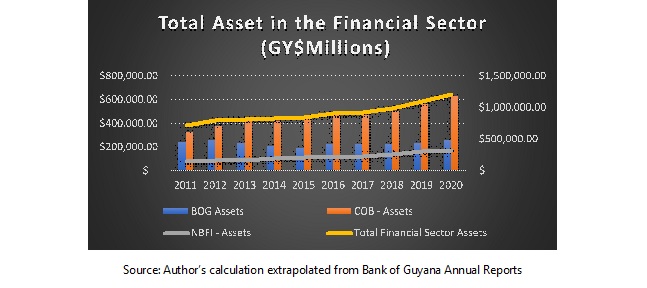

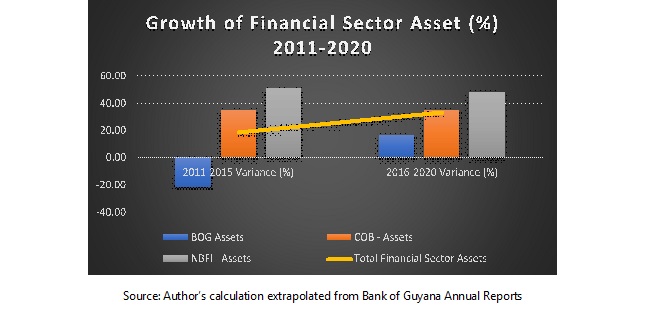

The data illustrated in the above graphs shows that the total assets in the financial sector, which includes Bank of Guyana total Assets, Commercial Banks Total Assets and Non-Bank Financial Institutions Financial assets, grew by $500 billion or 70% from the period 2011 to 2020. During this period Bank of Guyana Assets grew by 7%; commercial banks assets grew by 92% and non-bank financial institutions assets grew by 125%. During the period 2011 to 2015 Bank of Guyana Assets shrunk by 22% while commercial banks assets and non-bank financial institutions assets grew by 35% and 51%, respectively. The total assets in the financial sector for the period 2011-2015 grew by 19%. On the other hand, for the period 2016–2020 total financial sector assets grew by 34% higher than the level of growth during the period 2011 to 2015. During the five years period 2016-2020, Bank of Guyana Assets grew by 17%, commercial banks and non-bank financial assets grew by 35% and 48%, respectively.

Of note, one needs to bear in mind that the total assets in the banking sector and non-bank financial institutions which stood at $956 billion at the end of 2020, does not necessarily mean that this total sum is available to lend. Total assets in fact, includes the current loan portfolio of the financial institutions as well as existing investments in other instruments both domestically and in international capital markets. Therefore, to understand in simple terms how much money is available in the banking sector to lend – one has to examine the liquid assets of the sector. In this regard, according to the Bank of Guyana Annual report for 2020, total commercial bank liquid assets stood at $162.4 billion and the average level of liquid assets held in the sector amounted to $283.4 billion. Essentially, this is the sum that is available for lending.

This discussion will be continued next week.

About the Author: JC. Bhagwandin is an Economic and Financial Analyst, and an Adjunct Instructor at Texila American University, Business College. The views expressed are exclusively his own and do not necessarily represent those of this newspaper and the institutions he represents. For comments, send to [email protected].