Among the major challenges facing the local financial sector, particularly the banking sector, is the increase number of non-performing loans over the past 18 months.

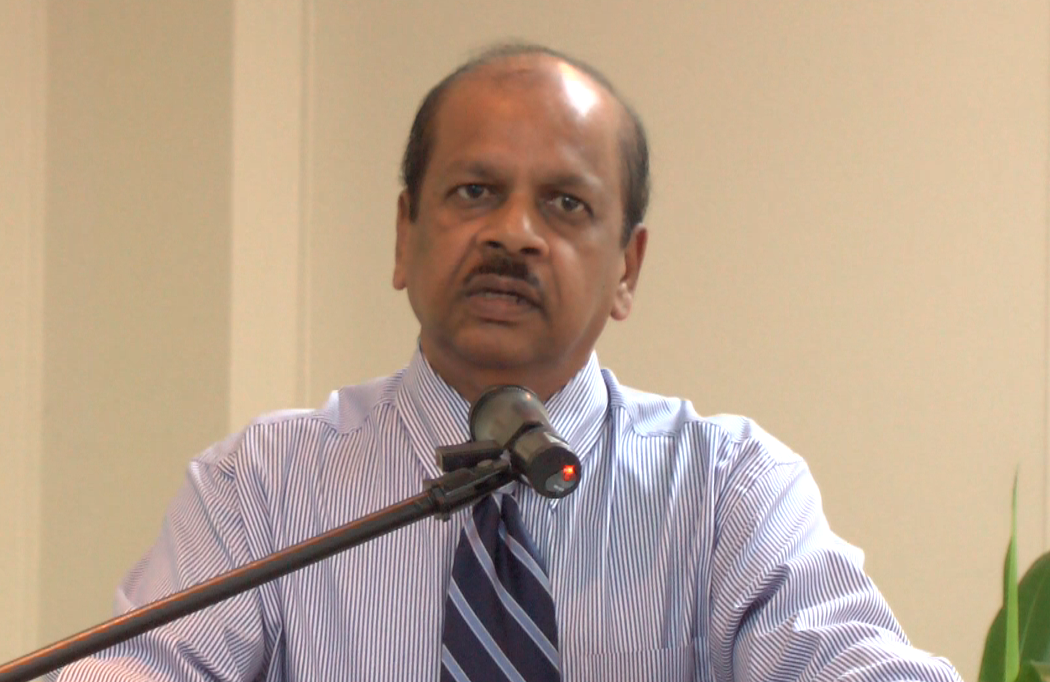

This is according to Bank of Guyana (BoG) Governor Dr Gobind Ganga, who told media operatives at a press conference on Thursday that the elevated level of non-performing loans, which was comparable to the levels in the Caribbean, was due largely to the decline in non-oil commodity prices and reclassification of exposes by a few banks.

“We have had a significant drop in non-oil commodity prices which would have affected some of the sectors that depend on the revenue from these sectors and as a result, given our strict regulatory regime in terms ensuring that loans which are not paid on time are being classified as non-performing, we would have had that increase that we are seeing,” Dr Ganga explained.

According to the Governor, the non-performing loans represented about 11.3 per cent of the industry’s total credit portfolio, which was about 1.3 per cent above the end-December 2015 level. He estimated some $28 billion in non-performing loans.

Moreover, the BoG Head pointed out that these non-performing loans are fully collateralised with sufficient provisioning for them within the banking system. Nevertheless, he noted that this issue is among top priority of the bank.

“Non-performing loans remain the focus of intense scrutiny by the Bank of Guyana as we continue to monitor and encourage financial institutions to implement measures to reduce this level of non-performing loans,” Dr Ganga remarked.

Meanwhile, during the press conference held at the BoG conference room, the Governor briefed the media on the state of the banking sector, saying that the institution was “efficient and effective” in its mandate as price and monetary stability was maintained.

He highlighted that at the end of September 2016, the licensed financial institutions (banks and non-banks) remained liquid, adequately capitalised, profitable. Dr Ganga added too that the capital adequacy ratio (CAR) for all licensed deposit-taking financial institutions surpassed the eight per cent minimum requirement. He noted that the industry’s CAR was 27.1 per cent, that is, 1.4 per cent above the December 31, 2015 ratio, thus indicating that the sector has adequate buffer to support it in adverse times.

Additionally, the BoG Head outlined that the Licensed Financial Institutions (LFI) profits for January to September 2016 amounted to $9,227 million, 68 per cent of the 2015 cumulative profits. He continued that liquidity levels remained high with the holdings of liquid assets surpassing the statutory minimum requirements, while adding too that the reserves with BoG also exceed the statutory minimum required level. Meanwhile, at September 30, 2016, the total assets for the LFIs amounted to $553 billion, 3.7 per cent above December 2016. The commercial banks accounted for 82.4 per cent ($455.5 billion) of total assets, up from 81 per cent ($433.5 billion) at end-2015.

Supporting this asset base were deposits of $433.9 billion, representing a 5.6 per cent ($23 billion) rise above the end-December 2015 level. This continued to signal the high level of confidence in the safety and stability of the financial sector.

Furthermore at the end of September 2016, total investments were pegged at $152 and represented 28 per cent of the industry’s total assets. Foreign investments accounted for 33 per cent of total investments of which 92 per cent were denominated in US dollars. In addition, the aggregate credit portfolio of the credit giving LFIs was $260.2 billion; while the credit to the Private Sector recorded a marginal increase, growing by less than one per cent ($.8 billion) to $215.3 billion. Credit to the real estate sector also rose by 3.0 per cent to $122.9 billion and accounted for 46.1 per cent of total credit, compared with 49.9 per cent at end-December 2015.

Discover more from Guyana Times

Subscribe to get the latest posts sent to your email.