Today’s article seeks to set the stage for a scholarly discussion on the symptoms of a currency crisis in the context of whether the Guyanese economy is experiencing any such symptoms at this point in time and what are the likely consequences of such. A currency crisis may be defined as a speculative attack on the foreign exchange value of a currency, thereby leading to sharp depreciation or forcing authorities to sell foreign exchange reserves and raise domestic interest rates to defend the currency (Glick, 2011).

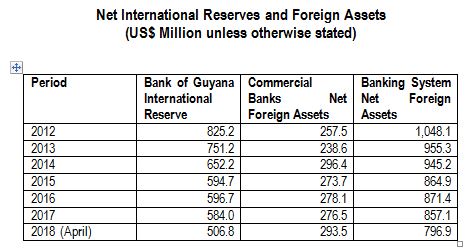

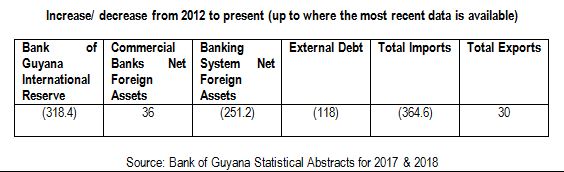

Analysts and other public commentators alike have often times highlighted the state of the international foreign reserves held with the central bank which has been depleted over the years. As the data illustrated in the tables above revealed, foreign reserves held with the Bank of Guyana declined from US825.2M in 2012 to US$506.8M as at the end of the first quarter in 2018, representing a depletion in the reserve of US$318.4M over this period or 38.5%. At the same time, the total banking system net foreign assets deteriorated by US$251.2M or by 24 % over the same period.

Analysts and other public commentators alike have often times highlighted the state of the international foreign reserves held with the central bank which has been depleted over the years. As the data illustrated in the tables above revealed, foreign reserves held with the Bank of Guyana declined from US825.2M in 2012 to US$506.8M as at the end of the first quarter in 2018, representing a depletion in the reserve of US$318.4M over this period or 38.5%. At the same time, the total banking system net foreign assets deteriorated by US$251.2M or by 24 % over the same period.

Space precludes further discussions on this topic for today hence, next week the author shall continue this discussion by using today’s article and data from the illustrations presented as the basis. In this regard, the broader dimensions and economic problems in Guyana’s context will be examined.

*The Author is the holder of a MSc. Degree in Business Management, with concentration in Global Finance, Financial Markets, Institutions & Banking from a UK university of international standing.