This w

eek I want to focus on the state of the VALUE ADDED TAX (VAT), which is a tax on consumption. A widening of the VAT bracket to cover more items like electricity and water is unlikely to improve the economic conditions of the people. There has been an uptick of taxes on production and consumption (mainly VAT and Excise Taxes), but no commensurate increase in benefits to the people. Those benefits can only flow with the expansion of the productive sector rather than devouring of the people’s consumptive power. This is an impetuous strategy that lacks intellectual depth and calculated reach.

We continue to hear about how this 2017 Budget will “deliver on the good life”, but for whom? I have an awkward feeling that this phantom prosperity promised by the Granger Administration isn’t something on which we can base our hopes for the future. No progressive nation in history has fostered economic expansion because of a tax burden that reached more than a quarter of its national income. This is the case in Guyana, yet the Government plans to finance a deficit budget that spends $140 million a day more than the Government takes in. Economic insanity!

How are we funding this runaway escalation of Government spending? Their answer is more taxes and more debt on the back of the Guyanese children. Most of these politicians who are incurring these debts today will not even be alive because of old age, when these children will be called upon to pay back these debts. Isn’t this high immorality on the part of the geriatrics in power? To compound this immorality, they have now gone and increased over 200 taxes on the parents of these children so that they can live a Cadillac lifestyle today in donkey cart economy? Leaders achieve lasting power and glory by exercising compassion and selfless service in the present moment for the people, but clearly, this is an alien concept to the power brokers in the Granger Administration.

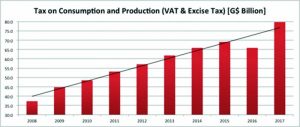

The graph below illustrates that the Granger Administration will have a revenue bonanza with this VAT on electricity. The big question remains, to what extent is this VAT destroying the consumptive capacity of the ordinary Guyanese and diluting the investment capacity of the Private Sector? We will assess the full impact of this situation when the Minister presents the 2017 half-year report. However, from all preliminary indications, this strategy will cause the Private Sector to invest less and the consumers to consume lower quality products and this will have an adverse impact on economic growth. This Granger strategy is nothing but a short-term money grab, which is expected to destroy the productive capacity of the economy in the long run.