Confronted with a debt of over G$345 billion at the end of 2017, the politicians are yet to convince the people that the “GOOD LIFE” is coming. This Granger government is exhibiting a mentality that says it can out-borrow, out-tax and out-spend any other government in the history of Guyana. But to what end? Where is empirical evidence to prove that all of this borrowing has helped to expand the productive sectors and productivity per capita?

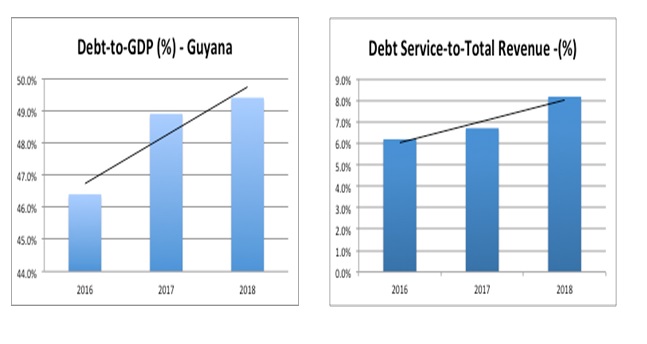

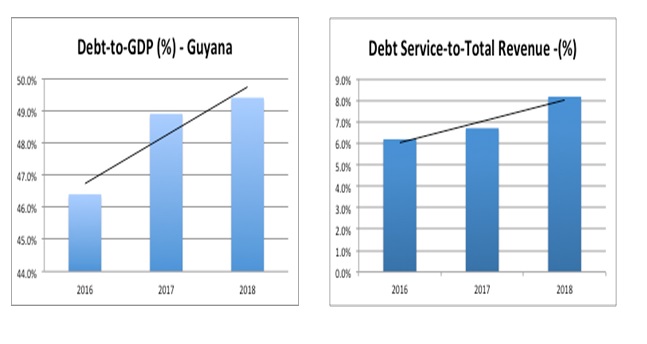

The two main indicators to identify debt stress in a nation are the Debt-to-GDP ratio and the Debt Services-to-Total Revenue ratio (see graph below). On both scores, the post-2015 government has moved in the wrong direction.

In May 2017, the Government of Guyana promised the IMF, in the Debt Sustainability Analysis process, a Debt Services-to-Revenue ratio in 2018 below 7.7%. But that was nothing but an empty promise, because, within 12 months, it had marched on these figures in the opposite direction, as the graph above proves. Today Guyana is rapidly moving toward a point of increasing its debt stress, with the Debt-to-GDP ratio set to surpass 50% in 2019, for the first time since 2014.

Why are these indicators important to the people? The Debt-to-GDP ratio tells the story of the ratio of the total public debt to the value of the total goods and services produced in that country within a year. This ratio indicates the ability of a nation to pay back its debt. A higher ratio speaks to the fact that it will become more difficult to pay back the incurred debt. To complicate matters, Guyana’s growth rate is currently in the “dog house”, thanks to the policy paralysis in the Granger regime.

The Debt Services-to-Revenue ratio is an indicator of the portion of revenue set aside exclusively to pay debts. The higher this ratio, the more difficult it becomes to repay one’s loans, and fewer dollars will be available for important services like education and healthcare. In economic management, a higher Debt-to-GDP ratio usually leads to a higher Debt Services-to-Revenue ratio. Today, all the indicators are pointing to increasing debt stress, thanks to the bankrupt economic policies of this Granger government.

In 1990, under the PNC, the Debt Services-to-Revenue ratio was 140%, which means that Guyana had to default on some of its debt in those days, because it could not meet its debt repayment. At that time, the international community deemed Guyana as uncreditworthy and technically bankrupt. By 1993, during the PPP administration, it had dropped to 105%, thanks to some work under Hoyte, but Guyana was still not out of the woods. By 2009, that ratio had dropped to 6%, thanks to a combination of efforts both locally (focused agenda from the PPP on paying debt installments) and internationally (debt write-off initiative).

However, since 2009, there have been serious concerns about how our debt stock was being managed. Loans are being borrowed, but it is unclear who has benefited from these loans. In a growing economy, the challenge is masked, and thus under the PPP, though it was a concern, it was not brought to the front burner. But when an economy is flatlining, as is happening today under Mr. Granger, we have a major problem, as the debt stress escalates without much recourse.

The solution is simple: increase revenue or cut expenses. What is happening today under Mr. Granger is revenue is flatlining and expenses are rapidly expanding. In the APNU/AFC Manifesto, the Prime Ministerial Candidate, Mr. Moses Nagamootoo, promised the nation that his government shall “cut out waste and extravagance and limit borrowing”. But as the evidence proved, Mr. Nagamootoo is just a button that Mr. Granger presses when he want to hear codswallop, because Nagamootoo’s word are nothing but hot air.

If one observes Table 9 in the National Budget, one can find that the travel cost of the government in 2014 was G$3.5 billion. In 2017, it was G$4.9 billion. This Granger administration has increased its international travel cost by over G$1 billion within 30 months. In those same 30 months, over G$300 million was spent on the two State Houses on Main Street for two families. Until this financial waste and extravagance is cut out, the only way to complete the financing of the budget is more borrowing. But expansion in debt not backed by expanding payback capacity destroys jobs and economic growth, and the world know it. Can we understand why the investors are not coming?