By Sase Singh, MSc – Finance, ACCA

When we think about a person’s economic well-being, we do not just think about how much they earn only. We also think about their belongings and investments, including their level of marketable education and skills. The same is true for a nation.

When it comes to assessing a country’s economy, the Ministers of Finance tend to emphasis Gross Domestic Product (GDP): that is the size of the economy. Or more precisely, the value of goods and services produced in one year by a country. However, used alone GDP does not provide the full picture of the health of an economy.

So what are Guyana’s assets? Firstly, all produced capital such as the production from our ‘six sisters’ – rice, gold, sugar, bauxite, logging, fishing – and new capital works in the nation like new highways and new investments count as assets. Then there are natural capital like our forest reserves and newly-discovered natural resources like oil. Most importantly, there is the quality of our human capital. This begs the question – are we retaining enough of our university educated people and others with the hard skills in the sciences and engineering at home? Then there are Net Foreign Assets (NFA), an element that has been propping up the Guyanese economy since 1998.

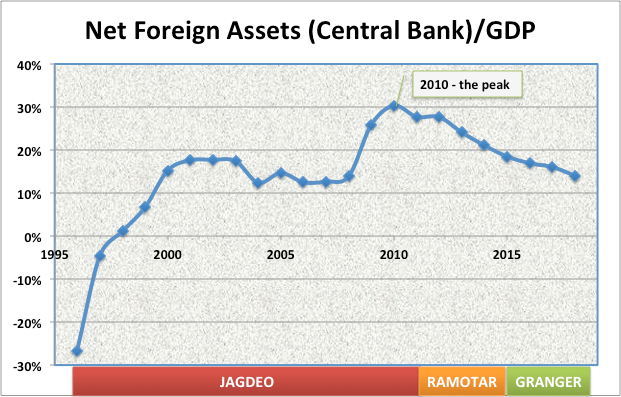

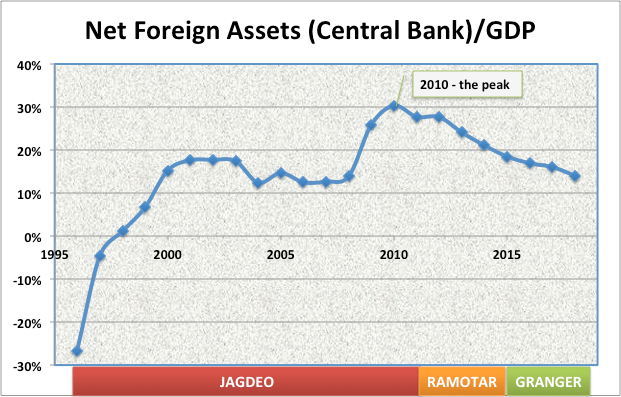

The graph above speaks to NFA/GDP. This graph basically tells you the story around the size of the convertible foreign assets that the Bank of Guyana controls to the size of the economy. Meaning, how easily we can pay our foreign obligations to fuel the local economy.

If we reflect on the state of the economy in 1985, just after the last rigged elections in Guyana (the year of Burnham’s death), we saw that the NFA/GDP was negative 410 per cent. That translates to the Central Bank being totally unable to meet its obligations to finance the foreign liabilities of the nation. They could have printed a world of Guyana dollars in those days, it was worth nothing since it was only paper money that was not easily convertible to trade internationally.

The situation actually got worse by 1991, which led to a further deterioration of this ratio of NFA/GDP to negative 497 per cent. The Economic Recovery Programme (ERP) kicked in and by 1992, the ratio had dropped to negative 193 per cent. The truth remains, the PNC transferred in 1992 to Dr Jagan a bag of economic bones from their graveyard of economic mismanagement. I am yet to see any economic facts that tell me that these people knew what they were doing in the pre-1990 days.

It took the PPP five years to reverse a decade of PNC maladministration with respect to the state of the NFA/GDP. If one looks at the graph, the state of NFA/GDP was climbing since 1992 and for 19 straight years, it improved so much so, that Guyana peaked in 2010 when the NFA was 30 per cent of the GDP. This meant that, if called upon to back all transactions in the economy, Guyana was ready to pay 30 per cent of those bills in hard currency instantaneously; a very different story from the year of Burnham’s death when this ratio was negative 410 per cent.

Since the dawn of the new era in 1992, all of that heavy lifting was done when two men took charge of the economy, first Dr Asgar Ally for a short period and then until it peaked in 2010 – Bharrat Jagdeo. Historical revisionists will never erase the job done by Mr Jagdeo as the key influencer who pushed the greatest growth in the wealth of this nation.

I would be the first to agree that in his last year as President in 2011, the NFA/GDP declined from 30 per cent to 28 per cent, but what has Mr Ramotar and Mr Granger done collectively to stem that decline since? Between 2011 when Mr Ramotar assumed office to the end of 2018 under Mr Granger, the NFA/GDP declined from 28 per cent to 14 per cent. That is a collective meltdown of 100 per cent thanks to the poor leadership of the economy under Mr Ramotar and Mr Granger.

The Net Foreign Assets at the Central Bank are set to decline even further in 2019 as the economic impact of the closure of four sugar estates digs in and this will further constrain the supply of foreign currency. Let us not forget that demand for foreign currency is expanding as the price of fuel and fertilisers increases. Mr Granger thinks that oil will solve all. DREAM ON, MR GRANGER!