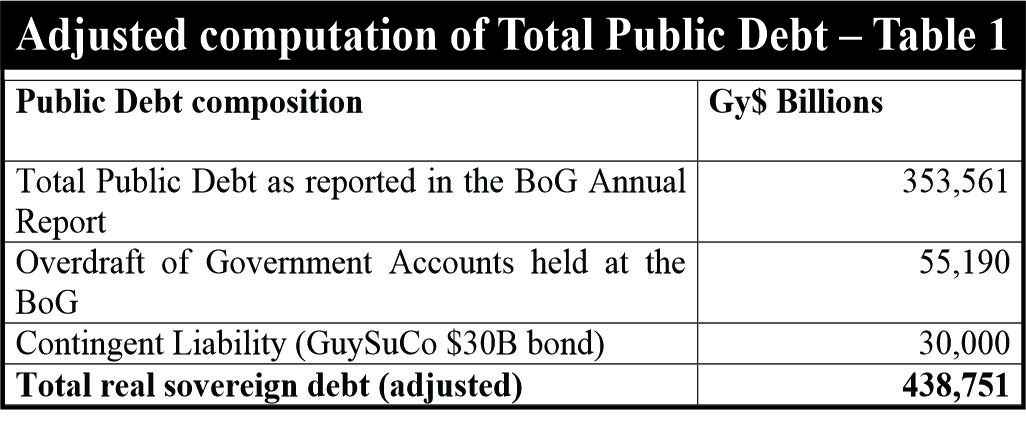

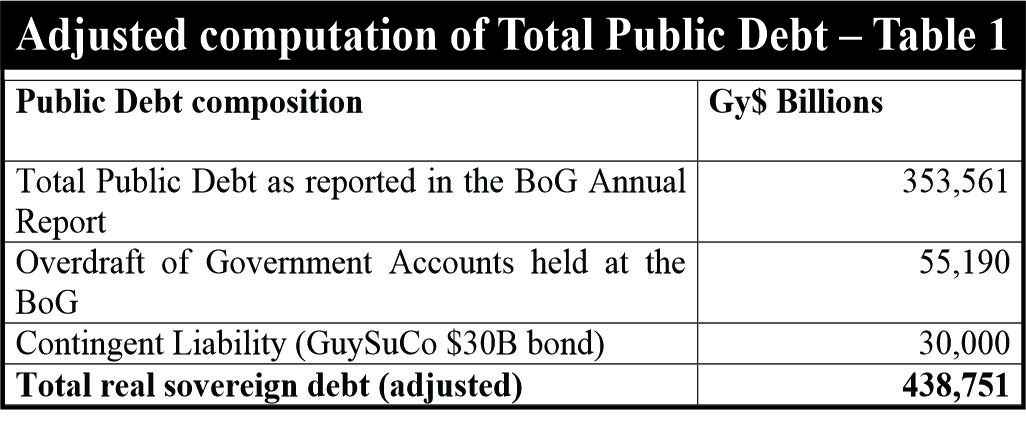

Today’s article focuses on analysing Guyana’s Sovereign Debt Sustainability position. In the Bank of Guyana’s Annual Report for 2018, it was reported that the total stock of Government’s debt increased by 1.5 per cent, representing 43.9 per cent of GDP. Table 1 below shows the breakdown and computation of how this level of Debt-to-GDP ratio was derived. That is, total domestic debt plus total external debt gives rise to 353.5 billion dollars (using an exchange rate of 208.5 for the external debt). Using the total debt figure of 353.5 billion dollars as the numerator and GDP in nominal terms of $805B as the denominator, this will give rise to 43.9 per cent.

However, this analysis shall focus on two important elements which this computation did not consider. Firstly, Government’s total debt of $353.5 billion did not consider the $30 billion bond which is a contingent liability for the Government, and also did not consider the $55.2 billion overdraft balance, which is also a form of borrowing, at the Central Bank. As can be seen from table 2, therefore, when adjusted to include these two other forms of debt, Government’s total debt in real terms is in fact $438.7 billion, rather than 353.5 billion as reported in the official reports. This effectively means that the total sovereign debt is understated in real terms by $85.2 billion.

The second factor that is critically important when analysing Guyana’s Sovereign Debt, in particular, is that it is typically measured as a percentage of GDP in nominal terms, rather than real terms. To this end, nominal GDP for 2018 was reported at $805 billion, while real GDP is about $689 billion.

Using the adjusted total public debt of $439 billion, the adjusted debt-to-GDP ratio is 54.53 per cent, instead of 43.9 per cent in nominal terms. It is more prudent, when contextualising these numbers, to use real figures, as opposed to nominal figures; as, given the unique nature of Guyana’s economy and its structure, these are important considerations one must not ignore as macro-financial analysts.

The real effects of debt

Empirical evidence suggests that high levels of debt are bad for growth and economic activity in industrial economies. To this end, when sovereign debt reaches 85 per cent of GDP, further increases in debt may begin to have significant impacts on growth. Countries with too much public debt may be potentially trapped in a debt overhang situation, which could lead to a default condition.

The highlighted key debt indicators presented above reveal that the current level of the total public debt is deemed manageable, healthy and sustainable, with adequate leverage for additional borrowings, if need be, provided that all other variables remain constant, or relatively unchanged within the current macroeconomic framework. Notwithstanding this, the central Government needs to manage its expenditure more responsibly. There is sufficient evidence in the public domain with respect to Government’s spending to corroborate this position — that Government has incurred, in some cases, unnecessary and exorbitant expenditure.

In concluding today’s piece, this assertion is supported by the fact that the one indicator that should lead to a more proactive approach in the management of the economy is the state of the country’s international reserves and net foreign assets held by the banking system. This outcome cannot be ignored, as it could have severe adverse implications not only for the economy overall, but also for the public debt management framework. It means that, with the steady depletion of international reserves and net foreign assets, the country would inevitably default on its external debt servicing obligation, especially as adequate foreign exchange may not be available to do so and to accommodate international trade. Imported goods would therefore become more expensive and/or the country may not have the capacity to import certain goods and services due to shortage of foreign exchange. Inflation would increase, and the currency is likely to depreciate further.

These are just a few of the consequences that could occur. Therefore, the risks highlighted herein and the situation with the nation’s international reserves need to be arrested now, to avert the risk of a depressed economy.