– Guyana heading into an economic crisis

Readers of this column would recall that in April 2017 and July 2018 this author dealt with this issue of foreign currency shortages. The findings and conclusions on the issue back then remained virtually the same again on the current issue of a shortage. However, there are some new developments which were also predicted in the analysis of this author in previous writings way back in 2017.

In the previous articles published in the 2018 column, this column contended that an artificial shortage tends to be created from time to time wherein, the commercial banks, narrowing this down, two of the six commercial banks are the real culprits that distort the domestic market by investing a greater portion of their foreign currency balances in foreign assets abroad to simply earn higher returns and to prop up their profits, instead of focusing on lending wisely and more prudently in the domestic economy. Based on the last available data, the level of their foreign investments abroad is about US$200 million or more.

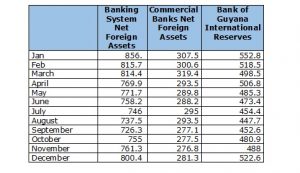

Bank of Guyana Foreign Exchange Intervention

US$ Million

Table 1.1

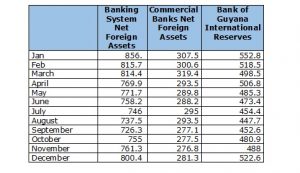

International Reserves & Foreign Assets for Jan – Dec 2018

US$ Million

Table 1.2

Other key Macroeconomic Data for Jan – June (Half year reports)

US$ Millions

Table 1.3

Source: Bank of Guyana Statistical Abstract

Having said that, in June 2017, another series of articles were written on the economic impacts of the closure of the sugar estates where again – this analyst had argued that sugar is one of the largest export earning commodity for the country. Export earnings from sugar in 2013 amounted US$114.2 million and in 2015 was recorded at US$81 million. Therefore, by reducing the level of sugar production thereby reducing export of sugar, the obvious consequence is that foreign currency inflow will be reduced drastically, which will eventually deplete the country’s foreign reserves, the exchange rate will depreciate as there will be a shortage of foreign currency, the local currency’s value will deteriorate. Further, with a depletion of foreign assets or foreign currency, the country will not have the ability to import foreign goods. Think of all the commodities and consumable items, luxury goods which we currently enjoy, importation of such goods will be constrained. Sadly, this is what the future of the country will be like, given the destructive policies in this respect and the direction policymakers are seemingly heading in regards to the touted actions they are seriously considering to pursue with the Guyana Sugar Corporation.

Fast forward now to 2019, it is unfortunate to say the least that these predictions of two years ago have now manifested. (The analysis of the data presented today will be continued next week).