…as remaining and relinquished blocks go out for auction next year

Guyana, which is expected to go out next year and auction oil blocks both untapped and relinquished, is likely to be in a good position to leverage the value of those blocks when the context of the global oil and gas industry is considered.

This view was expressed by Director and Chief Reservoir Engineer for Mid-Atlantic Oil and Gas, Dennis Pieters. The oil executive was at the time appearing on a webinar hosted by Americas Market Intelligence Analyst Arthur Deakin.

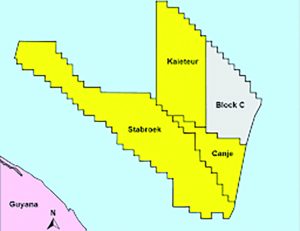

“They’ve got some blocks left and I think the Government would be within its rights to have a bid round, which is what President Ali and Vice President Jagdeo have talked about. A bid round in 2022. And I think that would probably be very successful. They’ve got Block C and the contracts signed by the oil companies including Exxon requires that they relinquish portions of the block, each year,” he said.

“So not only do they have block C, they have portions of blocks that are being relinquished. And these will come up for auction next year. In addition, they’re talking about having a 3D seismic done over these blocks so people can come and bid on it. So, I think it’s going to be open for business in 2022, because like we talked about initially about capitalising on that.”

According to Pieters, whose company alongside ExxonMobil, Total and JHI Associates Incorporated is a co-venturer in the Canje Block, the Government through Vice President Jagdeo has rightly said they will capitalise on the favourable conditions now. According to him, Guyana is in an extremely good position when the overall lack of oil and gas exploration in the world is considered.

“We’re in a good spot right now. There’s not a lot of exploration going on. The dollars have been cut by most companies. This is one of the only areas in the world where they’re actually continuing to do exploration and developing fields. And I think Guyana is in an extremely good position,” he said.

Dennis Pieters