It is important to note that there are four key business characteristics of upstream oil and gas activities. They are:

* High financial risk with high financial returns for the developer;

* A highly regulated industry;

* An industry impacted by global politics;

* Very technology intensive industry

The upstream industry is arguably the most complex of all the oil and gas business sectors. There are many risks and unknowns in the exploration process, but when you hit oil in commercial quantities (as happened in Guyana), the developer can make billions based on the contract. In Guyana’s case, hundreds of millions of dollars were spent by the developers (Exxon/Hess/CNOOC) and many years invested in the process. Remember, it took 22 years for the developers to move from signing the exploration contract with President Janet Jagan to real oil in 2021.

The upstream industry is regulated in terms of production, access to the reserves, pricing and taxation and some very stringent environmental regulations. In 2016, the Obama Administration issued a comprehensive set of new rules governing offshore drilling by American companies, after the Deepwater Horizon disaster that killed 11 rig workers and spewed millions of gallons of raw oil into the Gulf of Mexico. Those Obama regulations brought a renewed focus on the blowout preventers (BOP) that we spoke about last week (the device on the seabed that can seal off an offshore oil and gas well in the case of an emergency and prevent uncontrolled leaks). What is of critical importance is that the US Government mandates that the BOP be broken down and inspected every five years. In addition, today by law the oil companies have to hire onshore experts to monitor the seabed in real time for any leaks.

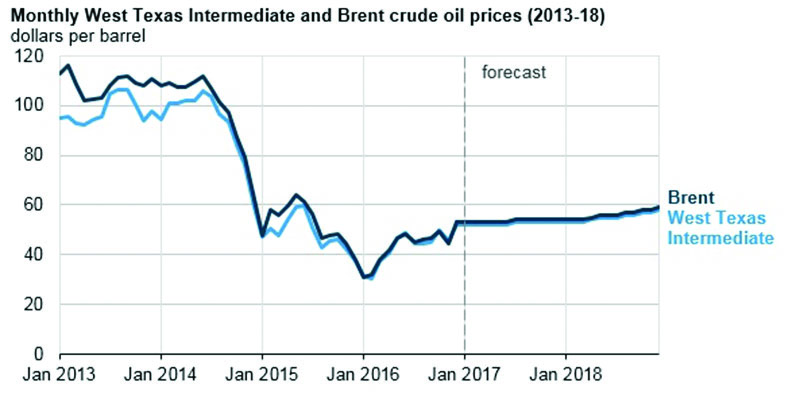

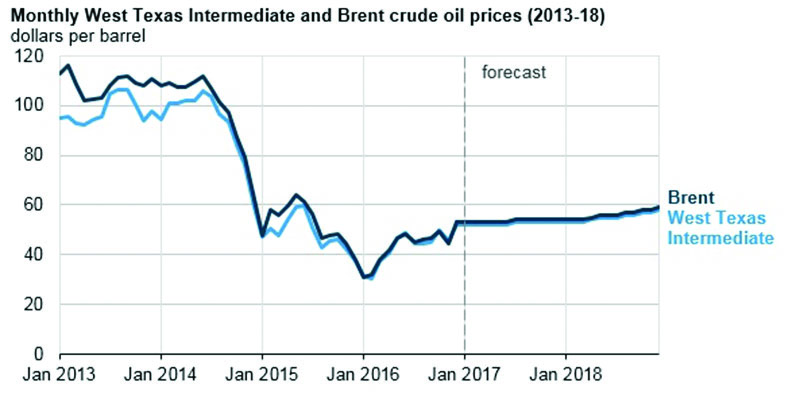

Upstream is also a global business. After two years of a low-price environment, a potential rebalance of the market is underway thanks to OPEC’s decision to cut production to bolster prices. But the increases in the oil prices have been sluggish at best mainly because of three reasons:

1. There is a large amount of oil stock to work through globally that is held in reserves.

2. The return of shale oil production. With a price above US$50 a barrel, fracking is back (the EIA project a price of US$60 per barrel by 2019 – see graph below).

3. There is a huge increase in the production of renewable energy in the major oil consuming nations and this has dampened the growth in the demand for oil and gas. The production of renewable energy is expected to double by 2030.

Finally, as we have seen in the previous column with the development of unconventional prospects, especially in off shore exploration, upstream oil and gas activities can be extremely capital intensive with much technology that requires less manpower compared to other kinds of economic activities.

So who are the main players in upstream activities? The four main categories of participants in the upstream sector are the majors, the National Oil Companies (NOCs), the independents and the oilfield services companies.

Major oil companies are those integrated oil companies that operate assets in all segments of the industry for example Exxon. The NOCs are those industry participants that are owned and managed by governments, for example, SAUDI ARAMCO. The Independents are usually smaller oil and gas companies that restrict themselves to a specific segment of the oil and gas industry and are not integrated like the Majors (for example CGX).

The oilfield services companies are important and often the most misunderstood part of the business. This sector includes those companies that provide specialised equipment, services and technical skills needed for a particular segment of the operations. Oilfield services companies do not normally produce oil and gas or own assets that do this sort of thing. At a typical well site, there are some 30 oilfield services companies working along side the developer to extract the oil and gas from the well.

Next week I was supposed to commence discussing the midstream segment of the oil and gas industry but I will pause on the series because of some major mid-year national financial developments that have happened in the Guyanese economy. We shall re-commence this oil and gas series sometime in September 2017.