Readers might recall that in March 2019, this column featured an article that was dedicated towards dissecting the 4.1% GDP growth of 2018. In that article, it was contended that the 4.1% growth for 2018 was attained largely because of the dramatic increases in Government expenditure in comparison to the corresponding period for 2017. It is important to note that while in theory – increases in Government expenditure are usually intended to stimulate growth in the economy. The key understanding that ought to be established in this regard is where these expenditure are allocated. If the expenditure is largely concentrated on unproductive activities such as national events, dietary, other operating expenses, local travel and subsistence, vehicle spare parts and service, and rental of buildings and things like that, then increases in Government spending like these will simply not translate to real developmental growth.

This article therefore builds on that previous analysis to further corroborate the arguments put forward therein. Further, it was noted that a NASDAQ report carried an ambitious projection of Guyana’s future trajectory largely on account of oil and gas where that report posited that Guyana is one of the fastest growing economies in the world. While some persons, including the politicians on the Government side, seem to have gotten excited with such report and is using it to help politicise their campaign agenda, one ought to understand that the context of that report was merely to highlight the potential that Guyana has – with oil wealth in the equation. Take oil out of the equation – the ordinary Guyanese knows that Guyana has always had huge potential – yet, it has never been able to achieve its full potential after more than 50 years of gaining Independence from British rule. Therefore, it is not to politicise and take such report out of the depths of reality, the true potential of Guyana can only be achieved vis-a-vis, the political will and leadership, the economic policies we pursue and prudent economic governance – which are lacking.

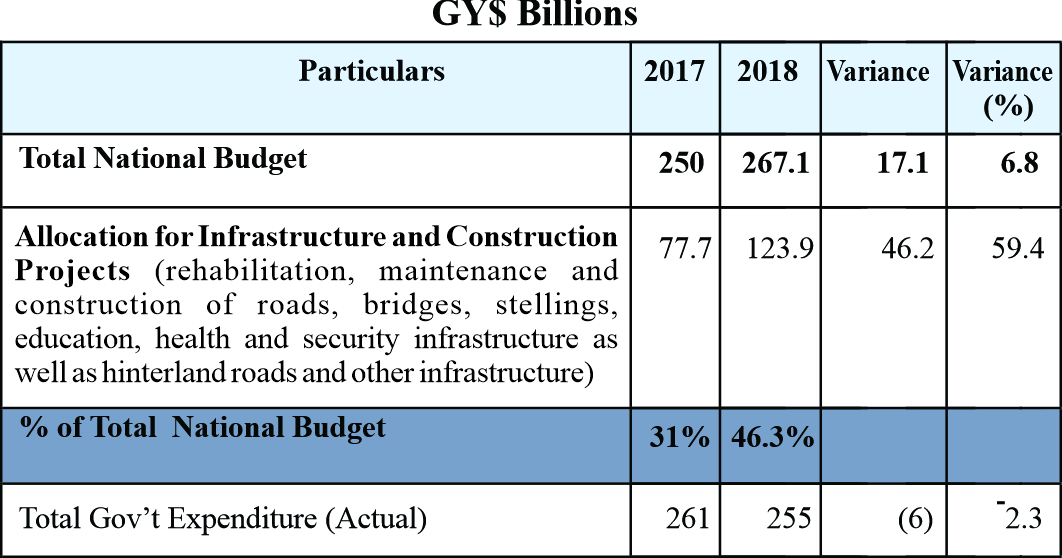

Turning now to the argument that the GDP was achieved on account of massive increases in Government spending, the Bank of Guyana report for 2018 actually noted that this outturn was driven largely by increases in the construction sector, manufacturing, bauxite, livestock, forestry and other crops. In scrutinizing the 2018 national budget to ascertain where the increases in construction came from, the data in the table above shows that the total Government expenditure for 2018 was $255 billion, 4 per cent less than the projections in the 2018 budget.

In the 2018 budget, it was found that 46.3 per cent or $123.9 billion was allocated to infrastructure and construction driven initiatives such as the rehabilitation, maintenance and construction of roads, bridges, stellings, education infrastructure, health and security infrastructure as well as hinterland roads and other infrastructure. In comparing similar allocations in the 2017 national budget, it was found that only 31 per cent of the total budget was allocated to such like projects which was about $77.7 billion, thereby resulting in an increase in 2018 of $46.2 billion or by 60 per cent relative to the 2017 budget.

Further, the Bank of Guyana report noted that total consumption expenditure decreased by 4.3 per cent or by a whopping $27 billion – compared to the previous year. Breaking this down into public and private consumption, private consumption decreased by $44.4 billion from $498.5 billion the previous year, while public consumption increased by $17.5 billion from $126.2 billion the previous year. If we are to examine where that loss of consumption expenditure went, the numbers show that it went in the form of taxes which is reflected in the increases in Government revenue. Government revenue for 2018 increased by $22 billion from $195 billion in 2017. This therefore corroborates the arguments that consumption spending decreased on account of increased tax collections coupled with massive increases in Government expenditure in largely infrastructure rehabilitation and maintenance – with no substantive new infrastructure development such as new road networks for example.