– Guyana heading into an economic crisis

In last week’s edition of this column, the author outlined the contextual framework concerning the issue of yet another foreign currency shortage scenario. In today’s edition, the continuation of the analyses of the data extrapolated (which was presented last week) from the Bank of Guyana’s statistical abstract is presented.

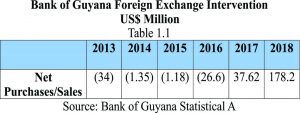

To this end, the numbers revealed that the Bank of Guyana intervened in the foreign exchange market for the years 2013 to 2018. The negative numbers of US$34 million in 2013 and US$26.6 million in 2016 show that, for all those years (2013-2016), the Central Bank has always been selling more foreign currencies to the commercial banks. In other words, the Central Bank has always maintained a net sales position of foreign currency with the commercial banks – who are the dominant players in the FX market; meaning, it has always been supplying FX to the commercial banks.

However, notably in 2017, this trend has reversed; that is, from a net sales position to commercial banks to a net purchase position from the commercial banks. In 2017, the Bank of Guyana bought US$37.6 million, and in 2018 it bought a whopping US$178.2 million from the commercial banks; thus giving rise to a total purchase of US$215.8 million from the private FX market in just two years – something that has never happened over the last ten years or so.

Now, when the central bank of a country has to buy FX from the commercial banks to this extent, this in itself is very worrying, and it means that there is a real shortage, owing to several factors which will be discussed. As was highlighted last week, since the closure of a number of sugar estates, Guyana has lost approximately 70 percent of incoming foreign exchange from sugar alone; while, in 2018, gold, which is currently the biggest foreign exchange earner, underperformed by US$20 million compared to the corresponding periods of 2017 and 2016.

Turning now to the net foreign assets position of the banking system for the year 2018, Bank of Guyana statistics revealed that its international foreign reserves reached a record low of US$452.6 million in September 2018, which is US$47.4 million below its target of US$500 million. Readers might recall that, in a previous column, the author explained the benchmark for this target, which is usually tied to the minimum import cover of 3 months. Therefore, from looking at Guyana’s annual import bill, three months of import cover is equivalent to about US$500 million. Figures for the commercial banks also showed that in January 2018, commercial banks’ net foreign assets stood at US$307.5 million, which depleted to US$281.3 million by the end of 2018, or by US$26.2 million.

These developments are an exact replica of a situation that occurred in Barbados last year. Barbados was about to experience a foreign currency crisis in 2018 wherein the Central Bank of Barbados’ foreign reserves went below its three months’ import cover target, and as a result, the Bank was forced to strike a deal with the commercial banks to buy up their foreign currency in order to maintain its minimum foreign reserves. Subsequently, before this situation erupted out of control, the Barbados Government quickly engaged the International Monetary Fund, which then came in to rescue the country by instituting a number of structural reform programmes aimed at achieving that country’s economic recovery. Unfortunately, there is at least one financial institution in Guyana with exposure in the Barbados Government’s debt instruments – which means that, with the IMF’s economic reform programme, that local institution may incur some massive losses in those investments.

To put things into perspective within the Guyana context against the backdrop of the current political dynamics of a looming constitutional crisis, a foreign currency crisis ultimately leads to an economic crisis. With the aforementioned factors leading to this outcome, it is no longer just a matter of an artificial foreign currency shortage being created, as was contended in previous articles. There is now a real situation of rapidly depleting foreign reserves, coupled with an increasing number of foreign companies in Guyana in the oil & gas related sectors. This effectively means that with this growing number of foreign companies operating here, this would inevitably add pressure or compound the issue wherein there is, and will be, a growing demand for foreign exchange to repatriate profits out of Guyana to parent companies. As such, Guyana’s economic outlook in the short to medium term – enveloped in a great degree of uncertainty and/or volatilities — is therefore worrying